UPDATE: See Honolulu County Real Property Taxes for 2021-2022

Things you should know for fiscal tax year July 2020 – June 2021

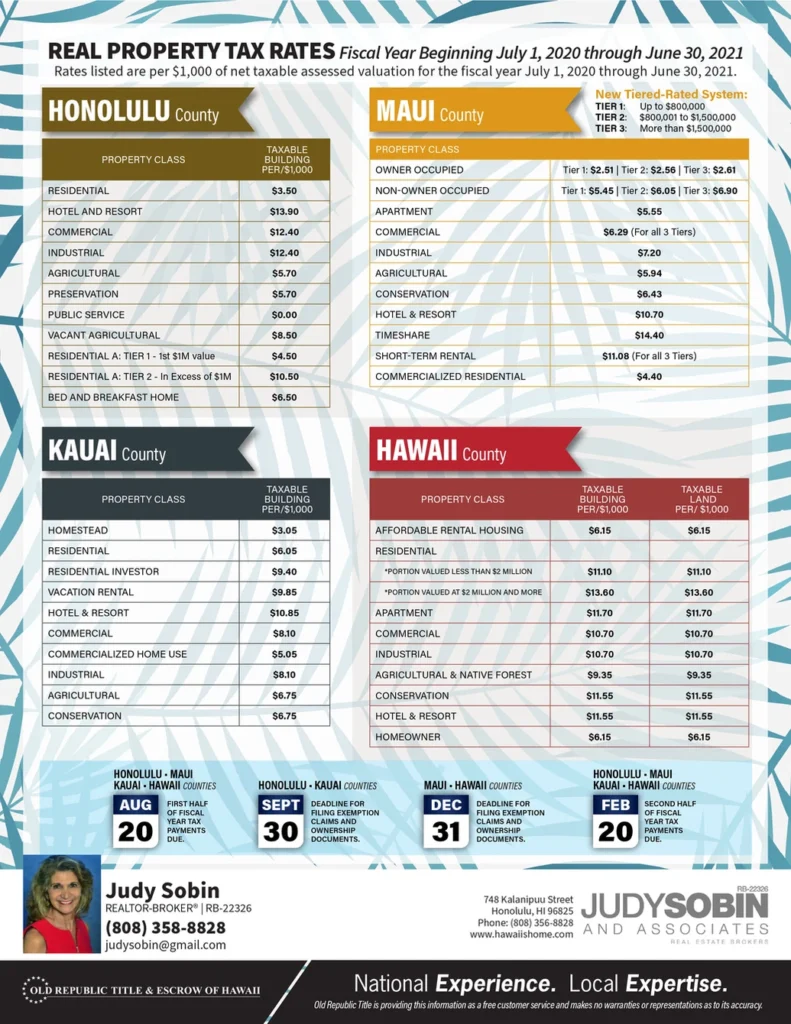

The Honolulu City Council has released the Oahu real property tax rates which will begin July 2020 and be effective till June 2021. Hawaii has one of the lowest real property tax rates in the entire nation and is essential because it provides revenue for public services, such as police, fire and emergency protection, water safety, parks, refuse, and other city services. The info explained here is for general information purposes only and based on the information on realpropertyhonolulu.com this is not to be considered as legal advice. Please consult with an attorney or accountant for specific inquiries regarding ownership, real property tax laws, and the appraisal process. Below is a chart of the property tax rates for each county in the State of Hawaii. I will explain the tax rates, how to calculate real property rates in Hawaii, primary residence exemptions, and assessment values.

Oahu Property Tax Rates | Honolulu County

There are 10 classifications for real property taxes in Honolulu County (which encompasses the entire island of Oahu) as of July 2020:

- Residential

- Hotel and Resort

- Commercial

- Industrial

- Agricultural

- Preservation

- Public Service

- Vacant Agricultural

- Residential A: (Tier 1 and 2)

- Bed and Breakfast

If you live in a home or own a home that rents to other people, you will typically be in these following (2) categories:

Residential: $3.50 per $1,000 Net Taxable Real Property Value or 0.35% of Assessed Value

((Assessed Value)/1,000) x (property tax rate)

The Oahu County Residential real property tax rate applies to homes where the owner lives as a primary residence. According to RealPropertyHonolulu, The real property must be owned and occupied as the owner’s principal home as of the assessment date (October 1st of the previous tax year) by an individual or individuals. Owner’s principal home means occupancy by the owner of the home in the city for more than 270 calendar days of a calendar year. Occupancy of the home may be evidenced by, but not limited to, the following factors: registering to vote in the city; being stationed in the city under military orders of the United States; and filing an income tax return as a resident of the State of Hawaii, with a reported address in the city.

An example of Honolulu county’s Residential real property tax rate:

An owner-occupied home with an assessed value of $800,000 would have an estimated tax rate of $2,800 before exemptions. ($800,000/1,000) x $3.50 = $2,800

Residential A: (Tier 1 & 2): $4.50 per $1,000 Net Taxable Real Property Value up to $1,000,000 (Tier 1) or 0.45% of Assessed Value then $10.50 per $1,000 Net Taxable Real Property Value in excess of $1,000,000 or 1.05% (Tier 2)

((Assessed value of home up to $1 million)/1,000) x (property tax rate) + ((Assessed value of home in excess of $1 million)/1,000) x (property tax rate)

The Oahu County Residential A real property tax rate applies to homes that are not owner-occupied and is based on a tiered system in which the tax rate is 0.45% up to $1,000,000 then 1.05% in excess of $1,000,000. The Residential A rate will normally apply to second homes, rented-out owned properties, and investor properties.

An example of Honolulu county’s Residential A real property tax rate:

A second home with an assessed value of $1,500,000 and is not a primary residence would have an estimated tax rate of $9,750 before exemptions. Tier 1($1,000,000/1,000) x $4.50 = $4,500 plus Tier 2 ($500,000/1,000) x $10.50 = $5,250.

Minimum real property tax

There is a $300 minimum real property tax for every parcel of taxable real property.

Home Exemptions – Honolulu County

So now that you know how to calculate your home’s or future home’s property tax rate, there are also homeowner’s exemptions which you can apply that will save you hundreds of dollars per year. According to RealPropertyHonolulu, the first exemption law was enacted in 1896 by the Republic of Hawaii to provide tax relief, encourage home ownership, and the settlement of land (at the time, the home exemption was only $300).

Basic home exemption

During this fiscal tax year 2020-2021, Oahu’s basic home exemption is $100,000. This means that $100,000 is deducted from the assessed value of the property and the homeowner is taxed on the balance.

Owners’ 65 years and older exemption

Primary Property Owners that are 65 and older have a home exception of $140,000. (To qualify for this exemption, you must be 65 years or older on or before June 30 preceding the tax year which the exemption is claimed.) Property owners with an existing exemption and their date of birth on file don’t have to re-apply for the new exemption amounts. The exemption will automatically increase depending on the age of the homeowner.

If we use the example from above of Honolulu county’s Residential real property tax rate with the home exemption added:

An owner-occupied home with an assessed value of $800,000 and a claimed home exemption would have an estimated tax rate of $2,450. ($800,000-$100,000/1,000) x $3.50 = $2,450 (originally $2,800 without exemption claimed) A savings of $350 per year.

How to qualify for the home exemption

- Owner-occupied property as your principal home

- Ownership is recorded at the Bureau of Conveyances, State Department of Land and Natural Resources, in Honolulu on or before September 30 preceding the tax year for which you claim the exemption.

- You file a claim for home exemption (Form P-3) with the Real Property Assessment Division on or before September 30 preceding the tax year for which you claim the exemption.

Assessed Values

Now that you know your property tax rate and home exemption information, you might be asking how does the county of Honolulu calculate the value of my property? You first must know that the assessed value of a home is not the price a buyer will actually pay for it. It is the value put on the home by an appraiser from the Honolulu Tax office who assesses and determines the fair market value through market data of sales comparisons and cost approach values. Each assessment is based on the status of the property as of October 1 preceding the tax year for which taxes are paid (the following year beginning July 1 through June 30).

Important dates for annual assessments:

- October 1 – Assessment date (assessment based on the status of the property on this date)

- December 15 – Notice of Assessment sent

- January 15 – Deadline to file appeal

- June – City Council establishes tax rates

- July 20 – First half of tax bill sent, due August 20

- January 20 – Second half of tax bill sent, due February 20

Being a homeowner on Oahu can be like living in paradise and we are lucky to have one of the lowest real property tax rates in the United States. For many of us, we don’t even see the money flow as it is paid through the bank that holds our mortgage. For others who do not have a mortgage on their property, they must pay directly to the county. If you have not filed for an exemption as an owner occupant, please do that asap. It will apply to next year’s taxes and save you some money.

I hope you found this information helpful in learning about Honolulu county property tax rates for 2020-2021. If you have any questions please feel free to Contact me. I work with buyers and sellers of real estate on Oahu. I provide analysis of your home for free and also distribute a free monthly statistical report on real estate on Oahu. If you want more information about real property taxes in Honolulu, visit: https://www.realpropertyhonolulu.com/help-resources/faq/.